Anarcho-Techno-Super-Capitalism Pt. 5

All Satoshis are created equal, but their UTXO histories aren't, especially in the 'Free State' of New Hampshire

Following my public resignation letter from the BSV Blockchain Association citing 2024 Presidential Candidate Aaron Day as a very big and important reason not to trust Randroids, it was great to see Aaron invited on the weekly Coingeek live stream last week in order for me to be able to ask him all the questions that have been on my mind with respect to Bitcoin, New Hampshire, the Free State Project, Project Veritas and Mike Gill. Aaron never answered any of the questions I asked at the time, but that’s because he’s running for President so he needs to play the long game, clearly.

Thankfully Aaron, now seemingly a BSV Blockchain convert, took time out of his busy Presidential campaign schedule to later respond to some of my queries on Twitter, after quoting Brendan Lee, who originally helped bring me into the BSV Blockchain Association as a teacher.

If Q-Anon is a CCTV camera in a New Hampshire police interview room, then maybe Aaron is telling the truth. I don’t really know much about this Q-Anon stuff, but I do know that Randroids aren’t so keen being objective and straightforward when it might cost them a dollar or two, so readers are free to make up their own minds from the video below.

‘Why is it that El Chapo’s cousin gets arrested in New Hampshire?’

— Mike Gill

Events and crimes listed, which are ‘in writing and time-stamped’ to quote Aaron himself, in this lengthy police interview include but are not limited to:

Death threats

Extortion

Witness tampering

Armed robbery of two banks

Fraud

Assault

Murder

Trafficking in large volumes of illicit Schedule 1 narcotics

Trafficking in illegal firearms

Bribery and corruption

Money Laundering

Racketeering

Names mentioned:

Dick Anagnost

Bill Griener

Andy Crews

Bill and Jeane Shaheen

Chris Sununu

The Shaheen and Gordon law firm represented Ghislaine Maxwell in New Hampshire, after her arrest. The ‘record-breaking $275 million jury verdict’ of which Steven Gordon boasts was against Mike Gill, the man who sat in the police interview room next to Aaron Day, Project Veritas co-founder and USA 2024 Presidential candidate, as recently featured on Coingeek.

Shaheen and Gordon were able to sue Mike Gill for $275 million, because that’s what his mortgage brokerage firm was worth, and he used his mortgage brokerage firm to campaign against those those whom a jury in new Hampshire decided, on the balance of probabilities, that he did defame. However, if Mike is even partially right, then the whole court is very well corrupt itself and the amount of the settlement, essentially his entire net worth, makes the case and the settlement even less able to define justice with respect to the true story and the true stakes. The drug rehabilitation charities that the defendants in the above case chose to give their settlement to are, according to Mike Gill, used to sell drugs to addicts and are just as much as any other part of their business operation, for example. Mike Gill’s settlement is of a similar order of magnitude to Cephalon’s settlement, $425 million, with the US Department of Justice in 2008 for selling fentanyl lollipops to people suffering from headaches, which many believe to have started the USA’s fentanyl addiction crisis that now kills 100 000 people per year.

Mike Gill gave the DEA direct evidence in their hands that led to the largest single fentanyl seizure in American history, but then the civil court decided that Mike Gill didn’t know enough about where the drugs came from or where the money went that they set a settlement with him, for defamation of those whom he accused, for 60% of the amount that those who started the fentanyl crisis to begin with settled for. I’m not sure what banana boat most Americans arrived to the ‘freedom and democracy’ party on, but whatever one it was it must have arrived yesterday in my view.

The same usual suspects, that Mike Gill worked with Aaron Day to expose, via Project Veritas and the now defunct State of Corruption website, are highlighted by the previously cited Claire Best on Medium, in relation to FTX, SVB, Ghislaine Maxwell and Jeffrey Epstein’s activities in Hew Hampshire and with respect to the Pandora Papers.

And while Aaron Day might find politics funny, he states himself, as a Presidential candidate that he doesn’t even believe in a ‘ballot box solution’ anyway, he also appears in another ‘Q-Anon trailer park video’ below, except Q-Anon is a WMUR 9 TV cameraman, not an interview room CCTV camera, and the trailer park is a courtroom, not a police station this time. Really all this Q-Anon stuff is too confusing for me, it must be one of those lost Lost in Translation things across the pond.

Just in case you missed it, screenshot below, of Aaron Day on another one of those ‘Q-Anon trailer park’ videos, whatever they are they always seem to involve police, lawyers, judges, network television, extensive criminality, and large sums of money.

Maybe Aaron Day is secret Q-Anon, and every night he puts his underpants on outside his trousers to save the world. But when he’s not it seems like he enjoys being economical with the truth.

Aaron is plainly sitting next to Mike Gill, who clearly did show up in court at some point, is clearly speaking with Aaron Day in the courtroom, but perhaps refused to sit in front of what he felt was a tampered jury and a corrupt courtroom during the process. Aaron’s side of the witness story and who got paid what is the opposite to that of Mike Gill. Mike’s contention is that Aaron’s insurance contract was set up as his way of getting paid off by the crooked court itself. If insiders know the verdict beforehand, then that’s the classic Lime Problem scam, where judges can collude with lawyers to use legal insurance as a free ATM machine.

Next Aaron tries to tell me some story about some guy, but it’s clearly not about that guy, or that story, anyway. Three murder attempts plus or minus one doesn’t change a story underpinned by $925 billion in Pandora Papers LLC money and everything Mike told police with Aaron sitting there backing him up.

When that particular point is put to Aaron, he talks about how Mike Gill, the man who paid the largest single defamation settlement in new Hampshire’s history, blocks him and accuses Mike of grifting, not the extensive list of criminal offences and seditious activity that he and Mike were detailing to police nor bothering to look at Mike’s GoFundMe page which is only half way to $10 000.

And Aaron seems to think there’s a joke in there somewhere, but I don’t see it personally.

Maybe the truth is that all TV and Radio in the USA are Q-Anon. I don’t understand the meaning of this Q-Anon thing, it must be some artifact of American culture or something.

The truth is that Aaron Day founded Project Veritas with James O’Keefe in New Hampshire, and that Aaron’s appearance before police was as part of Project Veritas’ first major journalistic investigation. Both James O’Keefe and Aaron Day worked directly for Mike Gill and the State of Corruption organisation, which Mike advertised on billboards and via his mortgage brokerage firm.

This is why James O’Keefe got booted from Project Veritas, why Aaron Day is an Ayn Rand Brony libertarian RINO LARPer dweeb on Coingeek pretending to know about BitcoinSV all of a sudden. It’s all just been a cop out since both of these guys dropped the ball on the biggest story of all that links straight back to FTX, SVB, Ghislaine Maxwell, Jeffrey Epstein and even the mess that is US Presidential politics itself these days.

Bitcoin Explain-ability

Name calling aside, it’s great that more people are interested in this novel data calculus tool called blockchain technology that helps us all to manage data and price risk more efficiently and effectively. A Satoshi defined by Satoshi Nakamoto, is the lower limit of an Unspent Transaction Output as defined by the history of the chain of UTXOs since the creation of that Satoshi as a block reward to a miner for finding a new block. A Satoshi also defines the lower Process Calculus limit of parallel communication in a network according to Bitcoin Satoshi Vision.

Every Satoshi with a UTXO history according to the Satoshi Nakamoto White Paper exhibits non-fungible properties already or has the potential to attain non-fungible properties with respect to its own unique UTXO history.

If Craig Wright is Satoshi Nakamoto as he claims to be, and if Teranode can perform hundreds of thousands of transactions per second at unbounded scale as he claims, then every Satoshi from the launch and creation of Bitcoin was always intended to have its own unique chain of UTXOs, to be able to attain that unique set of UTXOs as quickly as possible, by increasing the number of transactions per second in the Bitcoin network as much as possible, in accordance with section 2 of the Satoshi Nakamoto White Paper.

Therefore, according to Bitcoin Satoshi Vision, every Satoshi will also very quickly gain its own particular risk profile associated with its own particular chain of custody. Possible material events, or material risks, within that chain of custody are an outstanding liability to all those within that chain of custody and the wallet owner in which Satoshis reside. This is why BitcoinSV Satoshis bought OTC directly from miners with no UTXO history trade at a substantial premium to the BitcoinSV Satoshis available on exchanges, but the underlying dynamic is better explained by Daniel Robles’ work. There is strong market demand right now, especially from authentication providers, to avoid the material risks associated with the UTXOs on BitcoinSV. What there is and was no explanation of, however, is why these premiums are so high and what the material risks that buyers are paying to avoid are.

What Brendan Lee doesn’t seem to understand yet, although he is an extremely knowledgeable expert, is that Bitcoin only changes forward in time, and that Satoshi on the Bitcoin network has a transaction history that only gets longer with time. The Bitcoin mining nodes create blocks at the end of the longest chain of blocks, according to Section 3 of the Bitcoin White Paper, according to the network rules of the nodes in Section 5, and the random walk calculation in Section 11.

Bitcoin Core and BitcoinSV, in terms of the properties of Satoshis, don’t event try nor claim to fulfill the criteria of ‘Peer to Peer Electronic Cash’ as described in the title of the Bitcoin White Paper. Bitcoin Cash does, but the problem is that UTXO-based models inherently invoke uniqueness in each unit of account, and therefore exist on a material risk distribution curve, unlike cash which all trades the same. This material risk can be measured in many possible ways, but the main takeaway is that a Sat that’s been through 1000 addresses over 10 years on its journey to yours is more likely to have been involved in a chain of criminal and/or nefarious activity than one straight from a miner. That’s why OTC markets for fresh Sats from miners trade at an 80% premium.

The way to solve this problem is to build systems that grade Sats according to material risk, and group them into tranches, in much the same way that a credit rating agency does. This way, the lowest graded Sats can sent to some sort of ‘debt recovery’ agency and redeemed through charity or legal authority, with that process itself recorded on the blockchain itself. This thinking, this methodology should be baked into the network architecture from concept, especially for Craig Wright’s Teranode, otherwise Gresham’s law problems and other sorts of knowledge asymmetry problems will pollute the plumbing.

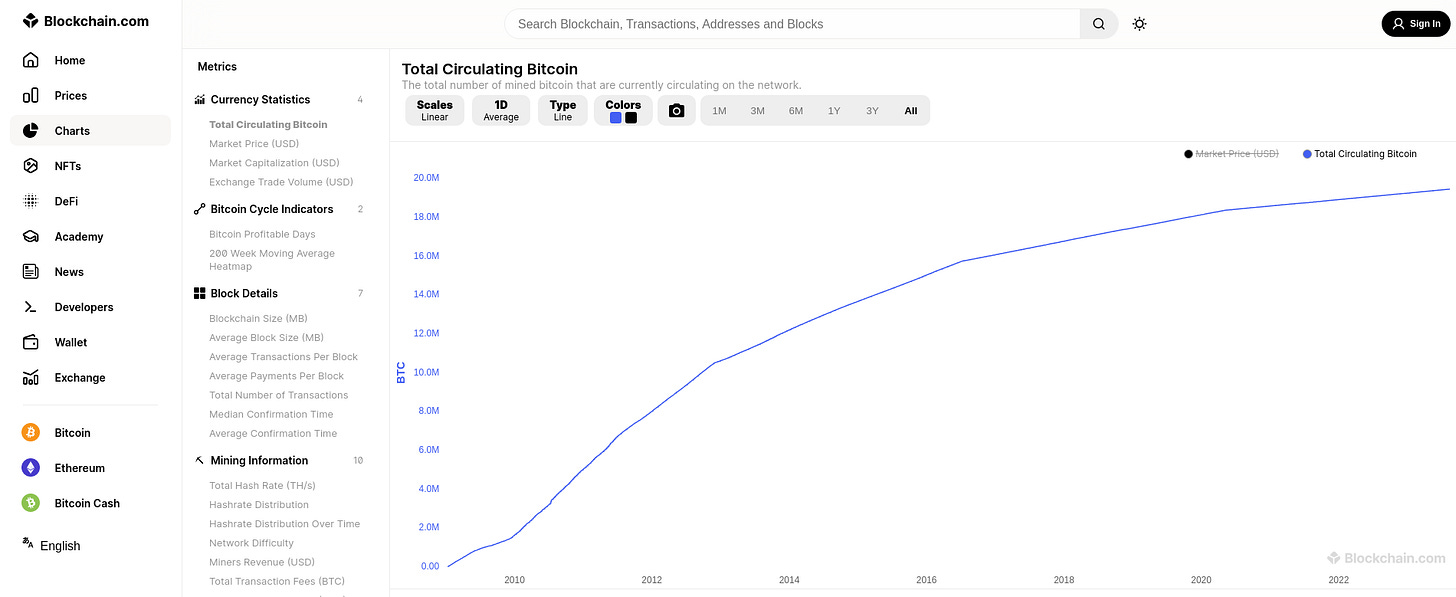

As of the time of writing there are circa 19.5 million Bitcoins in circulation. When Bitcoin Cash was created, there were 16.5 million Bitcoins already in circulation, when BitcoinSV was created, there were already 17.4 million Bitcoins in circulation. The vast majority of Bitcoins created, of any major fork, were created prior to those forks and prior to the Segregated Witness, block size and op code differences between stakeholders.

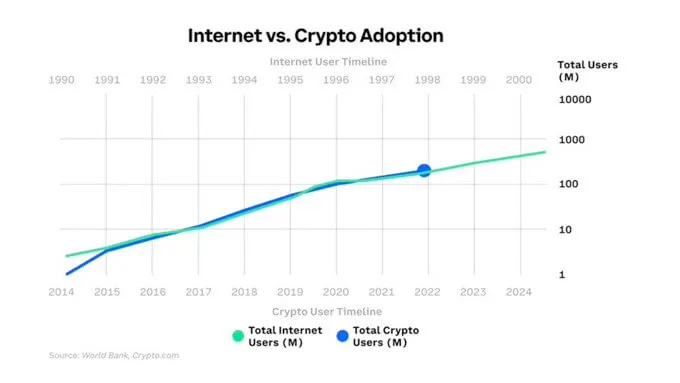

Most Bitcoins were created when the concentration of Bitcoin ownership was very high. In late November 2012, the 10.5 millionth Bitcoin (of 21 million possible Bitcoin ever) was created, when the first ‘Halvening’ event occurred. Half of the entire UTXO history of all forks of Bitcoin was created more than 10 years ago, in very specific circumstances amongst a much smaller network. At that time the main use case for Bitcoin was Dark Net markets for illicit drugs, such as Silk Road Marketplace, adoption was around 300 000 users, and New Hampshire was one of the main centers of adoption globally. It wasn’t until 2014 that Bitcoin reached adoption of 1 million users. The Bitcoin average owner concentration didn’t radically change from the Genesis concentration until the mid 2010s either, when Metcalfe’s law began to take hold, after half of all Bitcoins had already been created.

New Hampshire UTXO Concentration

The Bitcoin Material Event timeline:

January 3rd 2009. Bitcoin Genesis Block created, highlighting the moral hazard of the Banker Bailouts

50 Bitcoins created

0.0% of the total

~1 adopter

50 Bitcoin per user

February 2011, Mt Gox experiences liquidity problems, Silk Road Marketplace launched

5.5 million Bitcoins created

26.2% of total

~ 100k adopters

55 Bitcoin/user

Average concentration: 26.2% total / 100k users

June 2011, the Mt. Gox bitcoin exchange reported some BTC 25,000 (US$400,000 at the time) had been robbed from 478 accounts

6.8 million Bitcoins created

32.3% of total

~ 150k adopters,

45 Bitcoin/user

Average concentration: 21.5% total / 100k users

9.25 million Bitcoins created

44.0% of total

~300k adopters

31 Bitcoin/user

Average concentration: 14.7% total / 100k users

November 2012, half of all Bitcoins to ever exist in circulation are already created, First Bitcoin ‘Halvening’ event occurs

10.5 million Bitcoins created

50% of total

~400k adopters

26.25 Bitcoin/user

Average concentration: 12.5% total / 100k users

After the 1st Bitcoin ‘Halvening’

June 2013, Porcfest 2013: Subvert your government ft Vitalik Buterin and Vorhees, Mike Gill offered a $50 million settlement to shut down his State of Corruption, New Hampshire, campaign, which he turned down

11.3 million Bitcoins created

53.8% of total

~ 750k adopters

15.1 Bitcoin/user

Average concentration: 7.17% total / 100k users

October 2013, Silk Road marketplace shut down by the FBI

11.8 million Bitcoins created

56% of total

~850k adopters

13.9 Bitcoin/user

Average concentration: 6.59% / 100k users

January 2014, Development work begins on Ethereum

12.2 million Bitcoin created

58% of total

~1 million adopters

12.2 Bitcoin/user

Average concentration: 5.81% / 100k users

12.75 million Bitcoins created

60.7% of total

~2 million adopters

6.375 Bitcoin / user

Average concentration: 3.04% / 100k users

28 May 2014, Mike Gill’s first video laying out the corruption network in New Hampshire

12.8 million Bitcoins created

61.0% of total

~2 million adopters

6.4 Bitcoin/user

Average concentration: 3.1% / 100k users

October 2014 Tether created, very soon after HSBC were slapped on the wrist for money laundering

13.4 million Bitcoins created

63.8% of total

~5 million adopters

2.7 Bitcoin/user

Average concentration: 1.28% / 100k users

After Tether’s creation, the level of average concentration very quickly falls below 1% and Ethereum is launched in July 2015.

Bitcoin Now

August 2017, Bitcoin Cash created

16.5 million Bitcoins created

78.6% of total

~80 million adopters

0.21 Bitcoin / user

Average concentration: 0.098% / 100k users

November 2017, Bitcoin Satoshi Vision created

16.7 million Bitcoins created

80.0% of total

~90 million adopters

0.19 Bitcoin/user

Average concentration: 0.089% / 100k users

Craig Wright’s official story is that BitcoinSV forked from Bitcoin Cash because he is Satoshi Nakamoto, and because of all these tort law legal reasons. The real reason from a developer standpoint is that people like Roger Ver wanted a version of Bitcoin that resembled ‘Peer to Peer Electronic Cash’ as is the title of the Satoshi Nakamoto White Paper, while others wanted ‘Bitcom’ functionality as described by Steven Zeiler of Anypay, again based in New Hampshire. The Bitcom crowd, led by the pseudonymous ‘Unwriter’ created a Slack community, which is now defunct, supporting the Bitcom vision for Bitcoin.

The Unwriter Bitcom vision has since been brought into the fold of Project Babbage led by Ty Everret. Ty is an incredibly smart developer, but to turn his idea into a business he’s going to have to overcome the special interests currently leading him on, leading him into the Orwellian gingerbread house.

BSV Blockchain is Bitcom

Meanwhile The BSV Blockchain Association, whose purpose is to shepherd the Bitcoin Protocol, or rather the Bitcom protocol as most of the community in 2017 saw it, has now been co-opted by special interests to build CBDC architecture, largely following the guidelines of the Bank of International Settlements. Within that paradigm the Project Babbage Action Protocols will be a brilliant tool for rationing out the Ayn Rand Good Boy Points sponsored by Pfizer and the World Economic Forum, but they won’t actually enable nor work to uphold Western culture and values.

And in trying to educate others for free about this sort of stuff, Dr Craig Wright with his 100 university degrees and super high IQ, blocks me on Twitter. The simple answer is that he’s lying about some crucial facts related to core design features in the Bitcoin White Paper, and also his own Boomer tier Randroid philosophy regarding how the real world actually works.

The crucial thing to remember about Craig Wright is that he has a lot more in common with Trotsky than he does the Scottish enlightenment, which only came about as a result of free education, basic literacy for all, and two central banks, not just one. Craig might be a clever man, but clever doesn’t make authentic.

‘Marxists hate cosmopolitanism and globalism’ - Dr Craig Wright

'The understanding of how the financial International has gradually, right up to our epoch, become the master of money, this magical talisman, which has become for people that which God and the nation had been formerly, is something which exceeds in scientific interest even the art of revolutionary strategy, since this is also an art and also a revolution. I shall explain it to you. Historiographers and the masses, blinded by the shouts and the pomp of the French revolution, the people, intoxicated by the fact that it had succeeded in taking all power from the King and the privileged classes, did not notice how a small group of mysterious, careful and insignificant people had taken possession of the real Royal power, the magical power, almost divine, which it obtained almost without knowing it. The masses did not notice that the power had been seized by others and that soon they had subjected them to a slavery more cruel than the King, since the latter, in view of his religious and moral prejudices, was incapable of taking advantage of such a power. So it came about that the supreme Royal power was taken over by persons, whose moral, intellectual and cosmopolitan qualities did allow them to use it. It is clear that this were people who had never been Christians, but cosmopolitans.' - Christian Rakovsky, ‘Sinfonfa en Rojo Mayor’

BitcoinSV or BSV Blockchain, as it has recently been rebranded, doesn’t claim to be cash, nor does it claim that CBDCs are cash, and even it’s most clued in people view tokenised secondary future promises of gold production from a Bauxite mine in Guinea as validation of ‘tokenised gold’. Essentially the Bitcoin White Paper has failed to deliver the promise of P2P E-Cash. Unfortunately for the Peter Schiffs and other American ideological shills of the world, tokenised gold is not that, tokenised gold is what Colonel Qaddafi got murdered over, what his nation got turned into a dump by O’Bomber and Killary’s Team America World Police over.

If we understand the importance of Bitcoin infrastructure, and why so many powerful special interests are crawling all over it, then we will understand why it’s engineers that really make money, not bankers. Bitcom can automate banking away, it can’t automate engineering, human creativity and ingenuity, away. The fact that these people can’t even bring themselves to look at the New Hampshire problem over and above their own self interest shows this.

Infrastructure is something we depend upon to live, something we trust, because engineers designed it, and engineers are directly accountable for it. Bitcoin infrastructure is no different. What the Bitcom is is a data calculus tool that solves the handshake problem, such that it’s easier to form trust, manage risk, and invest in real engineering.

TTFN

I'll thank you not to lump bronies in with presidential candidates. We have our reputation to consider.