The Bitcoin Industry

Bitcoin has changed, everyone has a different story, let's make a coherent one

Part 1: The Economic and Cultural Background

Power Capital doesn’t play fair and Artificial Intelligence isn’t being used by those in power to help you, it’s being used to manage the stock market at the potential expense of everything you own. Remember: if you own nothing, you don’t even get to decide whether you’re happy or not, those who do own things do. We’ll call the dynamics explained thus far in terms of the predatory nature of Power Capital ‘Super-Capital’ which operates as an extension of the violence of the state for the sole purpose of power and power alone, in the same way that Carl von Clausewitz described war as ‘the continuation of politics by other means’.

Super-Capital is not ‘value neutral’. The video below gives four solid explanations as to how and why. Super Capital is ‘infinitely plastic’ as described by Mark Fisher and will happily absorb even anti-capitalist values into itself in order to further cement its own power.

This Bitcoin Genesis block encoded the 2009 version of the negative externalities of ‘Woke Capital’ incurred in the noughties: via the ostensible narrative of ‘universal home ownership’ the Labour Party under Tony Blair and Gordon Brown turned a blind eye while banks committed systemic fraud across the globe. Activists across the board from Anarchists to Ron Paul conservative libertarians to Marxist Leninists were united in condemnation of this. The story is best told and understood via the Hollywood adaptation of Michael Lewis’ book: The Big Short.

The legacy of these lessons is thus recorded within the Satoshi Genesis block, and in the beginning Bitcoin attracted a very diverse, an organically diverse, group of people who all wanted to implement a new system of finance.

Unfortunately, as in any revolution, differences in opinions about morality broke out early. Super-Capital is only too keen to pick and choose cultural trends, and assimilate those most favorable to its own aims into the ‘Borg’ (from the same root of the word bourgeois) in order to maintain its own grip on power. Keith Woods describes this best as a cultural phenomenon that took place in Cyberspace in the 2010s. Power Capital assimilated the parts of the ‘Occupy Wall Street’ movement that were most favorable to itself: those least threatening to its existing business model and those most well fashioned to generate differential advantage in the market.

The ‘Anarcho-Capitalists’ were the first to pick up on the utility of Bitcoin, and, for me, their take on the War of Drugs was refreshingly pragmatic in comparison to Lyndon LaRouche. But the problem with Lyndon LaRouche was, in the end, precisely the same problem that the War on Drugs itself had: it was co-opted by Power Capital to begin with, in much the same way that Power Capital now co-opts gender pronouns and genital transition surgery.

Craig Wright claims that heroin sales were a clear sign that Silk Road had become ‘too anarchistic’ but heroin sales at the very same time were funding NATO’s military occupation of Afghanistan. As he is an NSA contractor, he must have known this and must therefore also have known more about the motivations of others in the early 2010s than he lets on.

Therefore I believe that Ross Ulbricht was entrapped in a broader agenda. I will be as honest about that as that I had 50 Bitcoins in a Silk Road account when it was seized, that I was planning to use to buy cannabis from Africa, Africa has the best organic cannabis imho.

While Bitcoin is resolving its Power Capital issues following the take down of Silk Road and the spill over of the Culture Wars entering into the Bitcoin Github repo itself, Ethereum is launched as an allergic reaction to what Bitcoin was becoming. The founding principles of Ethereum were wrong technically, that Bitcoin could never scale and be Turing Complete, but were probably more correct in a broader sense that for Bitcoin to work it would require NSA contractors like Craig Wright and playboy billionaires like Calvin Ayres to lead it. The culture of Ethereum as a project was part of an allergic reaction allergic reaction to both ‘Woke Capital’ and increased state interference by intelligence contractor busybodies.

And the cultural and psychological result of this is what Mark Fisher called ‘Capitalist Realism’, but now perhaps on such a fully understood and visceral level that we can now solve it.

Part 2: The Bitcoin White Paper in 2022

Crypto as an industry emerged from autocatalytic sprawl of not trusting the introduction to the Bitcoin White Paper, so nobody knows which intermediary is correct. This is the economic and cultural background to the introduction of the Bitcoin White Paper at this time.

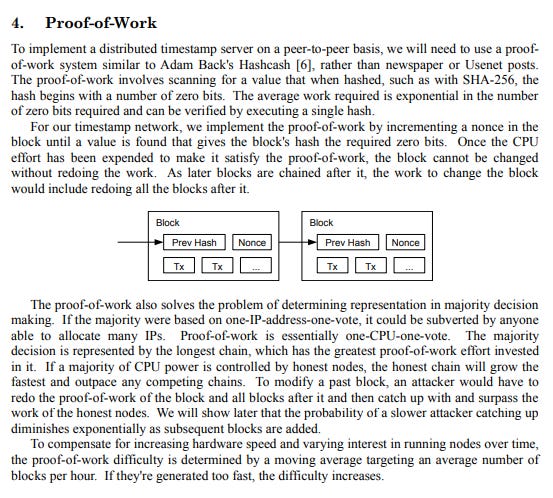

ASICS hashing has changed the fundamental nature of Bitcoin from an amateur hobby project into an industry. Craig Wright and Ryan X. Charles are both correct in their technical criticisms of the Bitcoin industry, and that BTC and BCH make no reasonable effort to implement Bitcoin as described in the Bitcoin White Paper. Where I differ with them, and the Bitcoin SV community in general, is that I still consider BTC, BCH and BSV as three separate forms of Bitcoin that each operate upon separate economic incentives contained within the Bitcoin White Paper. Each one with its own economic incentives and governance structures that exist due to unexpected outcomes of how Bitcoin was originally designed in retrospect.

Getting into the exact science of how and why BTC has monopolized the capability to create Bitcoin blocks will be saved for a later post, but suffice to say that, given the fundamental asymmetries of financial Power Capital described in previous posts, and given that ASICS hardware can be collateralized as a productive asset much more easily than competence in Bitcoin can, BTC only needs to create minimally viable blocks in a minimally viable network arrangement in order to gain hyper-financial leverage and make the creation of anything other than minimally viable blocks largely uneconomic in the ASICS hashing industry. Satoshi Nakamoto was wrong to assume that, given broader economic and cultural realities, that the ‘CPU power’ described in the introduction of the Bitcoin White Paper, given the chosen hashing algorithm, would organically produce the further outcomes contained within.

Only Bitcoin Cash and Bitcoin SV create a ‘coin’ as described in Section 2 of the Bitcoin White Paper. BTC creates reasonably practicable ledger entries for accounting purposes of profiting from the process of hashing to create new blocks itself. This profit motivation can be though of as a form of ‘price inflation’ or a ‘value sink’ that creates a fundamental cyber-security threat to how the Satoshi White Paper as a concept works in reality. From now on we will call this ‘Hashflation’

All three versions of Bitcoin operate perfectly well as a time stamp server. However BTC and BCH put hard limits on block sizes, which increases transaction fees or ‘rents’ on block ‘real estate’ in times of congestion. The ostensible reason for this is the low burden for node operation, but given that BTC hashing is a multi-billion industry, I don’t really believe Peter Thiel on that, to be honest, given that he’s read Henry George’s views about this sort of thing.

Pure ASICS Proof of Work, machine proof of work, is a cyber-security threat to the Bitcoin SV network. This requires engineers to manage, because BTC and BCH have no financial interest, at this time, to implement Bitcoin as described in the White Paper and every incentive to use their hash power in order to attack the network.

In order to demonstrate the fullness of Bitcoin, as described in the Whitepaper, Proof of Work requires a mixture of human and machine proof of work and law.

The hashers decide what is time stamped on blocks, therefore BitcoinSV node operators act as intermediaries to secure hash power for BitcoinSV nodes, and therefore have an inherent security role to prevent the BitcoinSV network being flooded with excessive hash power. BSV is therefore a ‘research project’ being protected by third parties, managed by the Bitcoin Association and Craig Wright’s patents, because Proof-of-Work cannot operate on the premise of ‘one CPU, one vote’, CPU cycles must be throttled given that ASICs hashing to find Bitcoin blocks is essentially an industry unto itself, and it has no reason to prove the creation of anything other than minimally viable blocks.

The BitcoinSV network operates as a Small World Network within a well defined model of Bitcoin as horizontally scale-able infrastructure, the best place to learn about this is BitcoinSV Academy. Again BTC and BCH don’t work in exactly the way the network is described in the Satoshi White Paper, but that’s because they don’t have to: due to Hashflation, the network described by the Bitcoin White Paper rents the ability to create its blocks from them, using the Bitcoin Association as a form of ‘letting agent’.

Given that industrialized hashing created unexpected economic incentives, the incentives of BTC are actually more ‘naturally’ well aligned between network participants: collectively maximize Hashflation. This produces its own oligarchy that behaves predictably like any other.

BitcoinSV effectively rents its ability to create blocks from the BTC Hashflation oligarchy, while defending itself from predation by it via the governance structure of the Bitcoin Association, patents, ongoing civil lawsuits, and a broad constitutional framework between node operators not to attack the network by utilizing too much of the vastly overpowering hashing capability of BTC. Due to Hashflation, the direct correlation inferred in the Satoshi White Paper between CPU time and electricity was reasonable in concept, but changed to a governance model (which involves a defined hierarchy) in execution.

All forms of Bitcoin adopt the Merkle Tree methodology for reclaiming disk space by only retaining block headers in order to be able to confirm transaction histories. However only BitcoinSV allows for unbounded block sizes, thus lowering rents for users to as low as can be reasonably practicable.

Only BSV uses Simplified Payment Verification, because it is intended to work with Big Blocks within a Small World Network infrastructure model. BTC’s intention to create the Lightning Network violates the very basis of the discrete logarithm problem in graph theory according to how BTC is set up as a network. Peter Thiel probably needs to understand that discrete logarithms are important in cryptography because of an inability to implement Segwit, Lightning and future scaling may be its ultimate undoing as a ‘reasonable’ engineering project with the intention to become a broadly accepted global ‘means of exchange’. Craig Wright’s proof of Simplified Payment Verification as a concept, while BTC struggles to implement its own scaling systems, proves that Craig Wright is at least the most knowledgeable engineer with respect to how the Satoshi White Paper was intended to work from concept, even if all versions of Bitcoin now differ from that concept to a lesser or greater degree.

All versions of Bitcoin operate on a UTXO model, but only in BitcoinSV is there no concept of transactional ‘dust’. A Satoshi fully understood is the minimum cost required to open a parallel channel for Simplified Payment Verification. Thus the ‘Satoshi’ the Satoshi White Paper includes its own concept of ‘Process Calculus’ and allows for robust horizontal scaling. A ‘Satoshi’ is, therefore, a minimum operational limit of Bitcoin and described in the White Paper for operation at global scale. Sections 8 and 9 are inherently linked in this way in BitcoinSV, which again proves Craig Wright’s very high levels of competence and knowledge regarding the Bitcoin White Paper’s conceptual design intent.

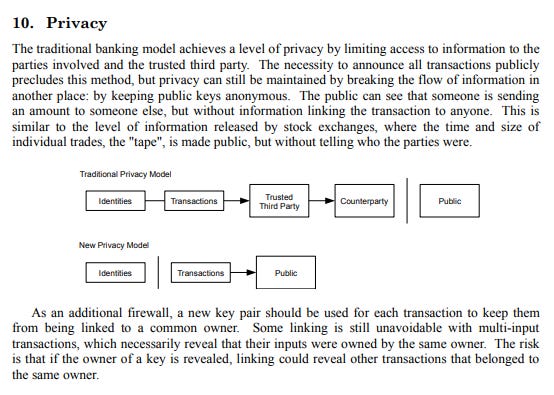

All versions of Bitcoin use the same fundamental privacy model.

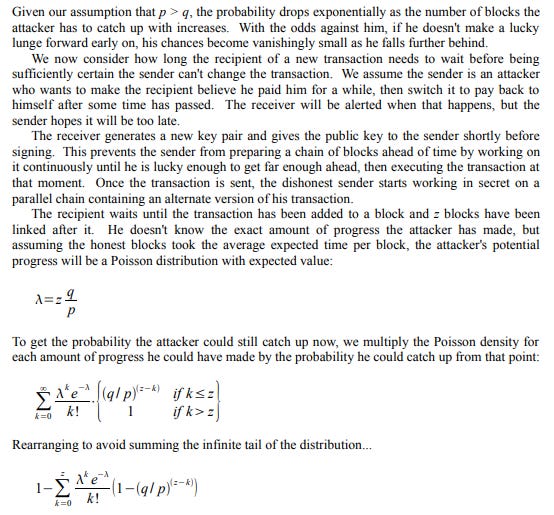

Only BTC can objectively claim to broadly follow the same cyber-security principles as described in the ‘Random Walk’ calculation section in terms of using ‘CPU power’ alone to ‘attack’ the network and keep the network in broad equilibrium. The result of the ‘random walk’ thus far, in terms of implementation of the Satoshi Whitepaper', is that based on the principle of ‘one CPU, one vote’, more than 99% of the CPUs voting upon how blocks should be created are voting not to implement the Satoshi White Paper but rather rather to promote Hashflation.

The secret of secrets: who is attacking what and why with what and how? This is now a complex cybersecurity and industrial strategic issue, not just about the mathematics contained within the White Paper. The original incentives contained within the Bitcoin White Paper failed to deliver Bitcoin as described in the White Paper without leadership, without the state, without the law. Thus actors within the Bitcoin network will interpret the random walk calculation according to their own human incentives as a product of business and industry, rather than as the simple ‘objective’ calculation described below.

In terms of the conclusion of the Bitcoin White Paper, all forms of Bitcoin rely upon different forms of trust. BTC’s basis of trust lies in promoting Hashflation and remaining in broad equilibrium and consensus with respect to the Random Walk calculation section. Bitcoin Cash operates in broadly the same way and is also not seen as a fundamental threat to the Cre-Order of Capital as created by BTC. Bitcoin Cash is to BTC what Pepsi is the Coca Cola, essentially. Trust in these two forms of Bitcoin largely exists absent competence and absent state intervention.

BitcoinSV, however, in order to protect the ‘Satoshi Vision’ from Power Capital promoting stagflation in order to accumulate unto itself, is reliant upon trusting in the mechanisms of its own governance organisation, the Bitcoin Association, the legal system, the state and more. Therefore Proof of Work, Incentives, and the simple random walk mode of attack in the Calculation section of the Bitcoin White Paper did and do not operate as Satoshi intended. The system proposed for ‘electronic transactions without relying upon trust’ created three forks each operating upon their own imperfect mechanisms of trust, none of which are an exact match of what is contained within the Bitcoin White Paper.

Conclusion

In this way, despite BitcoinSV ostensible derision of ‘Proof of Stake’ as a mechanism of network consensus, BitcoinSV, via nChain and the Bitcoin Association, operate a tacit Proof of Stake consensus mechanism amongst node operators, using Proof of Work as a technological tool in order to create and timestamp blocks. This is because BitcoinSV cannot operate according to the Satoshi White Paper as expressly defined.

BitcoinSV must defend themselves from Hashflation and Power Capital stagflationary accumulation more broadly, otherwise the more subtle aspects of the Bitcoin White Paper cannot be expressed fully, and it therefore Bitcoin cannot scale horizontally as defined in the concept.

This shows that, due to the Capital as Power framework, human beings must stake their creativity, their competence, their trustworthiness in order for inventors, creatives and engineers to be able to solve problems before Power Capital sabotages their efforts for differential advantage.

Thus those who say that ‘BitcoinSV is leaderless’ risk falling into the trap of using Bitcoin to accelerate and worsen the problems highlighted within the Satoshi Genesis block. Craig Wright is sanguine about ‘Woke Capital’ concepts in banking such as Central Bank Digital Currencies, sanguine about ESG regulations, sanguine about anything that can be built within the existing framework of Capital as Power that will make money for BitcoinSV. It was this sort of uncritical attitude towards how capitalism really works that led to the banking crisis in the first instance.

Also BitcoinSV is not the Bitcoin described in the White Paper, certain aspects of the concept were sacrificed in order to deliver others. This is just normal project management, and it doesn’t justify this cult of ‘Craig Wright definitely is Satoshi Nakamoto’; it doesn’t justify the Bitcoin White Paper as a unilateral contract either. Most importantly BitcoinSV proves that capitalism is not a perfect system and that there must be anti-capitalist safety measures baked into how Bitcoin works in order for it to work at all in the face of fundamental asymmetries.

TTFN