Many of the younger generation are now familiar with the concept of ‘Know Your Customer’ (KYC) via their interactions with stock trading apps such as Robinhood and via cryptocurrency speculation. It’s great that basic literacy in money and finance is becoming a ubiquitous feature in the lives of young people today, but what many people don’t know is the history behind how regulations such as KYC came about.

A couple of years ago my cousin in law once removed, who has worked for both the IMF and the World Bank in his long and illustrious career, explained the history to me in very stark and simple terms: as much as half the available cash in global investment markets at any one time comes from either grey or black market sources. Regulations such as KYC were implemented as a ‘sticking plaster’ over a much larger and more sinister systemic problem.

The size of global criminal economies is staggering:

If the cost of global cybercrime were a country, it would be the third largest economy in the world, after the USA and China, and it inflicted $6 trillion of damages to the global economy in 2021 and that figure is estimated to grow to $10.5 trillion by 2025

The global drug trade is worth an estimated $400 billion per annum

The modern slavery trade is worth an estimated $150 billion per annum

Every dollar of money received via the proceeds of the criminal market that is then reinvested into the lawful marketplace has morally hazardous effects on the law itself in market-based economies. The investment preferences of criminals are, quite naturally for the preservation of their assets, to perpetuate more crime. The culture created by criminal markets is toxic to the health of any nation. The term ‘Narco-State’ describes a nation whereby the proceeds of illegal narcotics directly fund the structures of power themselves. Note-able examples are Afghanistan under NATO occupation, Nicaragua, Colombia, Panama, but now even the West itself is falling under the grip of these dynamics of lawless capital. HBO TV series The Wire, widely regarded as the best TV series of all time, shed a stark light on this: the money and the politics of money exists largely above the law, but ordinary people must exist within within the markets created by supply, demand and the way that the laws and regulations are enforced within them.

YouTube is replete with examples of the socio-economic effects of this in North America.

And in the country where I grew up, went to school, university and earned my stripes as a professional Chartered Chemical Engineer in the oil industry, the social divide between the haves and have-nots was apparent to me from an early age. Recently I had held out some hope that the Taliban’s eradication of the poppy crop in Afghanistan would make a dent in the drug abuse problem there, but Mafias and Cartels being the shrewd business people that they are planned ahead by replacing heroin from Afghanistan with cocaine from Ecuador, making Scotland now the highest per capita consumers of cocaine in the world.

The economics of hacking the dopamine circuits of the youth at scale in nations is not, however limited to the Glaswegian Mafia and the Ecuadorian cocaine cartel: Siren Server platforms like Facebook, Instagram, Tik Tok have turned this into an industrial scale networked business model. This business model is capable of creating addiction, mental illness and rewiring the neurological circuitry of the brain to modify user behavior, virally spreading misinformation, subverting democracy, and, even, fomenting hatred at scale to such an extent as to cause war and ethnic cleansing.

The users of these Siren Server platforms are not the customers of these platforms. Users use Siren Servers in order to provide the customers with data, and these customers could largely be anyone, with regulations around how Siren Server user data is used being largely non-existent outside of GPDR and Shrems II.

Also, under the paradigm of neo-liberalism, abstractified capital itself is the controlling factor in people’s lives. After what anyone has done to make money has been recycled back into the money system, no value judgements can be made about the nature of the motivation of that capital when it makes demands on workers as a hierachical system of power. Thus value judgements boil down to libidinal urges.

It could even be said that Scotland switching from heroin to cocaine as a drug of choice marks a cultural shift between the normalisation of depressive sorrow of Thatcherite late stage capitalism into the normalisation of the raw libidinal programming of attention deficit driven Capitalist Realism in Cyberspace (or the Metaverse as well now call it), but to say that in any meaningful sense in a neoliberal paradigm would require a knowledge market which is probably only available to drug cartels.

The baseline level of this should be familiar to anyone who has worked in a major multinational corporation or for government, and that is the phenomenon of ‘Bullshit Jobs’ as described by David Graeber.

But what David Graeber describes as ‘Bullshit Jobs’ is only a symptom of toxic hierarchy. Lawless abstractified capital gains much from keeping its mid level and low level workers engaged in pointless busywork. This pointless work sabotages their personal development and their awareness of lawless abstractified capital as a power process, which accumulates capital via systemic fear and strategic sabotage. The Hypernormalisation of pointless jobs is, in and of itself, an effective and strategy to keep a workforce of gatekeepers in constant fear and gives executive management ample opportunity to sabotage any worker’s career for failing any obedience test.

Diego Gambetta, another expert in market asymmetry and capital as a power process in markets of second hand goods, highlights that incompetence signalling is an important secondary signal of generalised criminal activity within any criminal hierarchy. Signals of incompetence demonstrate obedience and loyalty to the fundamental competence of hierarchy’s ability to gain and sequester resources, because the incompetence itself would not survive outside of it. Therefore I hypothesize that, given the conclusions of the Capital as Power framework and Diego Gambetta: the more state actors signal incompetence in matters of infrastructure, law enforcement, infrastructure construction, the more the abstractified neoliberal capital that dictates the preferences of the state is criminal in nature.

Money: Typeless (The Ultimate Derivative) or Typeful (The Ultimate Integral)?

Neoliberalism, whereby abstractified capital itself is the ruling mode of production, benefits from an epistemology whereby money itself is abstractified as the ultimate typeless derivative of the production process. Neoliberalism takes advantage of this property, because it allows finance itself to reproduce, untethered from real capital stock and income services, via what Suhail Malik and Ulf Martin term ‘Auto-catalytic Sprawl’.

This ‘Auto-catalytic Sprawl’ gives rise to Exeter’s Asset Pyramid, whereby roughly 20x global GDP is traded within the Neoliberal Power Capital Hierarchy, priced according to the systemic risk of the market failing, not the systemic benefits to the experiences of people, to the environment, or even capital stock and income services:

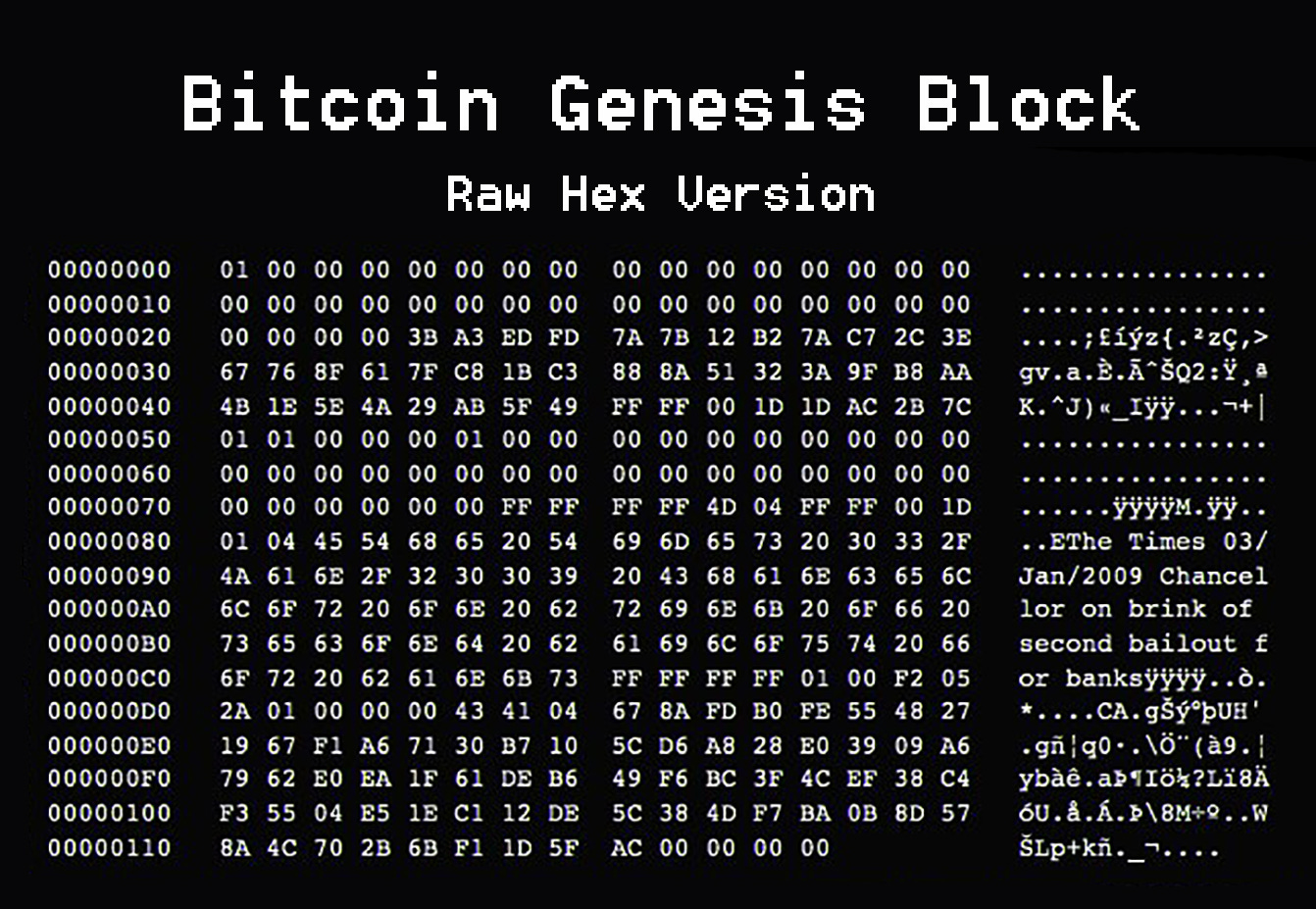

The most widely directly experienced manifestation of this effect of Neoliberal Power Capital holding people to ransom via the auto-catalysis of financial products and their derivatives was the 2008 financial crisis. Ordinary people were lured into the process of auto-catalysis via easy mortgage applications with next to no documentation relating the capital stock nor income streams. Captured regulatory agencies enabled auto-catalysis under threat of systemic fear and strategic sabotage, until finally the threat was extended over the entire global population via the banker bailouts. The history of this is contained within the Bitcoin Genesis block:

What the Satoshi Genesis block hides, however, is the competing interests of Capitalism as a process at scale:

A power process as a system unto itself

A shared creative experiential process between participants in a value network

Some sort of reasonable mix of the two given existential and cybersecurity concerns

If communities make mistakes, it is not necessarily unreasonable for a center of capital to bail them out of their mistakes, but the crux of the Bitcoin issue emerges from the nature of predictive capability, risk management, security and insurance and their relationship to the asymmetries of knowledge in markets, the Capital as Power Process and therefore ‘governance’ issues such as democracy and human rights.

One simple way to discern network participants’ motivations is to discern how much they value safety and life itself. If network participants value roads, for example, and argue for obedience on the basis that without it, there would be no roads, in order to build roads rationally, one must value road safety. And road safety, in the UK for example which is a global benchmark of commonly accepted best practice, values the cost of a life at circa £1 million. If, in any economic network, someone proposes the lower the cost of a life at scale to less than £1 million, that, therefore, is a red flag of mal-intention.

No bailout to an human system can be of value, beyond Malthusian and Klauswitzian concerns, if that bailout comes at a future cost to life.

In order to examine finance as the ultimate typeful integral of a global process of nurture, maintenance and co-creation, we must first understand the two possible models of capitalism as a socio-economic process:

The Nitzan and Bichler Capital as Power Process

The Daniel Robles Capital as Creative Process

The nature of how finance is measured as capitalized power within a hierarchy is central to what the hierarchy itself is really doing teleologically. The more risk management and personal risk appetites are shrouded in systemic fear, and the less engineering competence is devoted to genuine maintenance of existing infrastructure, greenfield project development, innovation and care for new life, the more Power Capital within any system of capital is acting as a pure power process for its own benefit and the less it is acting as a process that benefits life as experienced for everyone.

Know Your Customer, But Know Your Leader Better

It is not my aim to present solutions in this article, only to help my readers to understand that their fears about how modes of power are and could be being used around them are worth thinking about, and that they aren’t crazy nor conspiratorial for questioning them. In a system where Cash is King, and where processes of regulation of where the cash comes from are far behind the processes of how the cash itself creates more cash, and the owners of that cash protect and self-replicate the processes of capital to gain and retain assets, it is good to reflect upon our own demands from for our own life and whether and how the demands of abstractified and essentially lawless global capital meet our own demands.

Mack Story sums it up best in the meantime.

Until next time.