Interface Sovereignty: Ireland’s Evolving Economic Architecture

How a Narrative-Driven, Operationally-Compartmentalized Model Went Cryptographic

Further to

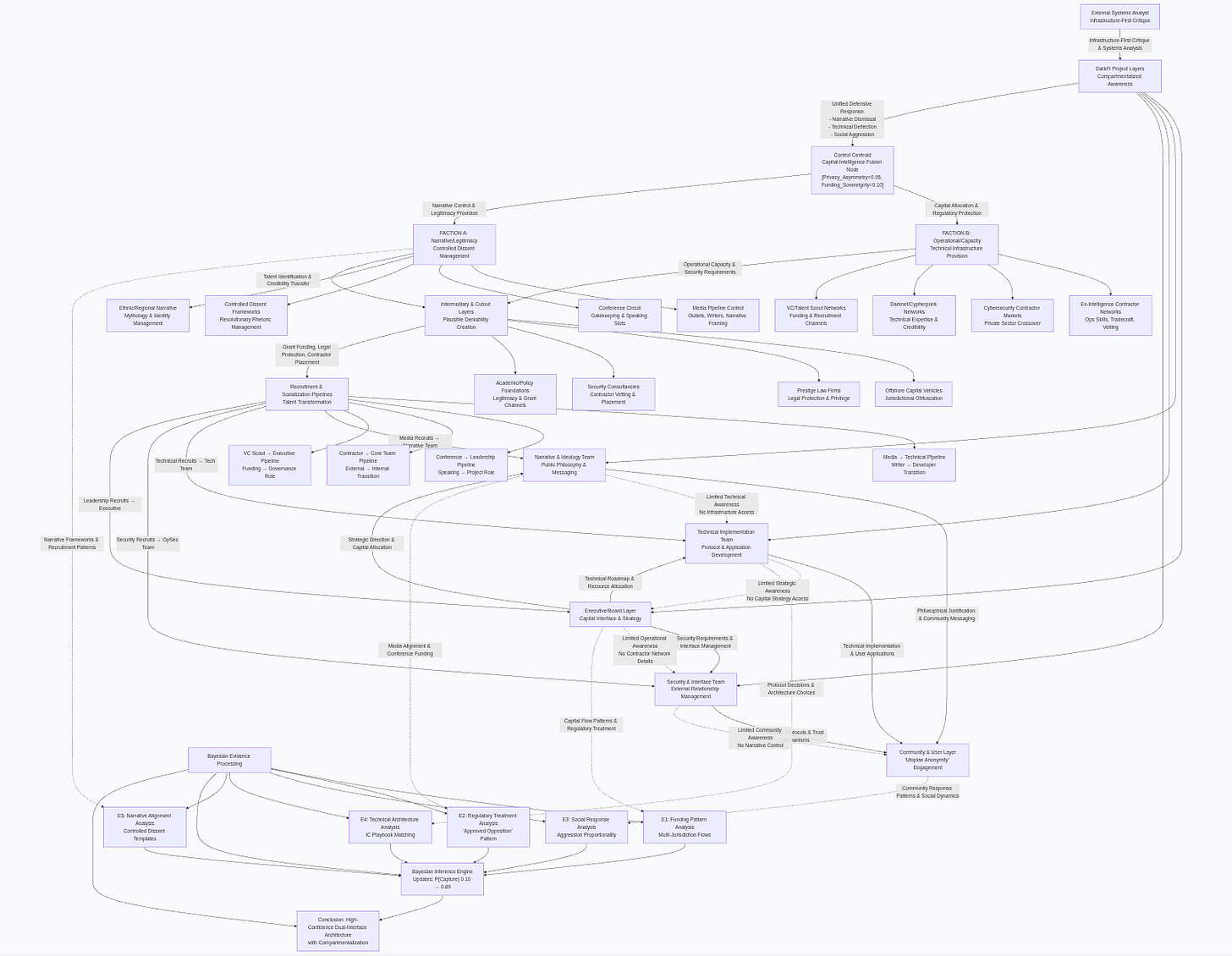

that this capital interface and signalling graph, far from being a conspiracy theory, can easily be pitched and formally described as a sensible and normal business model and natural progression of Ireland’s relationship with techno-capital and its existing diapsora and ethnic network state of commerce and techno-capital. Created with Deepseek.

Introduction: The Irish Interface, Encrypted

From an Irish perspective, the architecture depicted is neither novel nor alarming—it is simply the mature expression of an economic model perfected over generations. Ireland’s prosperity has always been built on a sophisticated duality: attracting global capital through compelling narrative while managing its operational integration through specialized legal and financial structures. The system’s genius lies not in production, but in interface management—translating external capital into local legitimacy, and ambiguous origins into reported GDP.

This model has now evolved from its analog foundations into a cryptographically-enforced reality. The dual-track system—where narrative development and operational delivery run in parallel—is merely the formalization of what Ireland has long practiced: storytelling to attract flows, and structured intermediation to manage them. The compartmentalization that might appear conspiratorial is, in fact, standard operational security in a jurisdiction whose primary export is trusted intermediation.

What critics might frame as a laundering mechanism is, in the Irish context, a sophisticated service industry. The privacy asymmetries and sovereignty trade-offs are not flaws; they are the value proposition. This architecture represents the natural next iteration of Ireland’s core economic competency: being the most reliable, efficient, and narratively sophisticated intermediary in a fragmented global system. The future was always here—it just wasn’t encrypted.

The Challenge of Building Revolutionary Technology Today

In the 21st century, transformative technology ventures face a paradoxical challenge: they must simultaneously inspire revolutionary change while navigating complex regulatory environments, securing diverse capital sources, and attracting specialized talent across multiple jurisdictions. Traditional organizational structures—whether corporate hierarchies or flat open-source communities—struggle with this multidimensional balancing act.

A New Architecture Emerges

We’re witnessing the emergence of a new organizational model that resolves these tensions through parallel development tracks. This dual-interface venture architecture separates two critical functions that traditionally conflict within single teams:

Track One: Narrative and Cultural Development

This track focuses exclusively on ecosystem building, brand positioning, and philosophical leadership. It manages media relationships, conference circuits, and cultural identity frameworks—not as marketing afterthoughts, but as strategic assets that create “cultural moats” around technical innovation. By channeling revolutionary energy into productive directions, this track builds legitimacy and community while managing dissent constructively.

Track Two: Technical and Operational Delivery

This parallel track concentrates on practical implementation—protocol development, security architecture, and product deployment. It leverages specialized talent networks (including former cybersecurity and intelligence professionals) and operates with focused autonomy. This separation allows technical teams to work without being burdened by constant narrative management, while ensuring their work aligns with broader strategic objectives.

The Innovation: The Translation Layer

Between these tracks sits a sophisticated intermediary system that enables coordination while maintaining necessary separation. This layer includes:

Legal and jurisdictional structures that navigate regulatory complexity

Talent transformation pipelines that convert philosophical passion into technical skill

Capital flow optimization across multiple jurisdictions

Plausible deniability systems that protect operational security

This intermediary layer doesn’t just connect the tracks—it actively translates between domains, converting cultural capital into technical specifications, philosophical vision into practical implementation, and regulatory constraints into design opportunities.

Internal Structure: Compartmentalized Excellence

Within the venture, specialized teams operate with optimized awareness:

The narrative team focuses on philosophy and community without technical distraction

The technical team concentrates on code without strategic overload

The executive team manages capital and regulatory relationships without operational micromanagement

The security team handles external threats without internal disruption

This compartmentalization isn’t about secrecy—it’s about focus. Each team operates at maximum efficiency within its domain, with coordination occurring through carefully designed interfaces.

Continuous Learning Through Bayesian Optimization

The architecture includes built-in feedback systems that continuously analyze:

Capital flow patterns across jurisdictions

Regulatory responses and enforcement trends

Community engagement and narrative resonance

Technical performance and security metrics

This evidence-based approach replaces ideological rigidity with adaptive strategy, allowing the venture to evolve in response to real-world signals rather than predetermined dogma.

The Economic Model: Value Creation Through Translation

The venture creates value through multiple streams:

Knowledge Arbitrage: Leveraging information asymmetries between domains

Talent Premium: Access to specialized networks and transformation capabilities

Jurisdictional Optimization: Navigating regulatory environments more efficiently than competitors

Brand Valuation: Cultural narrative as appreciating asset and protective moat

Why This Matters Now

This model represents the natural evolution of venture building for complex, high-stakes environments. It’s particularly suited for:

Technologies operating in regulatory gray areas

Projects requiring both revolutionary vision and practical implementation

Ventures that must balance public engagement with operational security

Initiatives that span multiple jurisdictions and cultural contexts

The Irish Context: From Bridge Economy to Sovereignty Hub

Ireland’s economic history has always been about translation—between US and European markets, global technology and local talent, corporate structures and startup innovation. This venture architecture formalizes and scales what Ireland has done intuitively for decades.

Today, Ireland stands at a natural transition point: from being a tax arbitrage hub to becoming a sovereignty arbitrage hub. This model provides the framework for that transition, allowing Ireland to leverage its unique position as a bridge between different forms of sovereignty—nation-state, network-state, and corporate.

The Future of Venture Building

The dual-interface venture architecture doesn’t replace traditional models—it evolves beyond them. It acknowledges that in a fragmented, complex world, successful ventures must operate in multiple domains simultaneously without internal contradiction. They must build cultural capital as economic moat, maintain operational security through intelligent compartmentalization, and adapt continuously through evidence-based learning.

This is the organizational model for building the future while navigating the present—for creating revolutionary change within evolutionary constraints. It’s not the architecture of pure revolutionaries or pure pragmatists, but of the builders who can connect vision to reality, passion to implementation, and innovation to impact.

The Dual-Interface Venture Architecture: Next-Generation Organizational Design

Executive Summary: The Networked Sovereignty Model

What we’re observing isn’t a traditional startup or open-source project, but a dual-interface venture architecture optimized for navigating 21st-century complexity. This represents the natural evolution of organizational design in response to three converging realities:

Regulatory Fragmentation: Different jurisdictions require different operational approaches

Capital Liquidity: Global capital flows demand sophisticated routing and protection

Talent Specialization: The best contributors work across multiple domains and jurisdictions

This architecture doesn’t replace traditional corporate structures—it evolves beyond them by creating parallel tracks for legitimacy-building and operational delivery, connected through sophisticated intermediary layers.

Core Architecture: The Dual-Track System

Track Alpha: Narrative & Ecosystem Development

Function: Creating market legitimacy and cultural capital

Components:

Media and Narrative Engineering: Controlled deployment of revolutionary rhetoric through vetted channels

Conference Circuit Management: Strategic speaking engagements that build credibility while avoiding regulatory triggers

Cultural Identity Frameworks: Leveraging ethnic/regional narratives as brand assets

Controlled Dissent Systems: Managing revolutionary energy toward productive channels

Business Value: Creates the cultural moat that protects technical innovation from political attack.

Track Beta: Technical & Operational Delivery

Function: Building and deploying actual infrastructure

Components:

Specialized Talent Networks: Access to former intelligence and cybersecurity contractors

Technical Guild Systems: Compartmentalized development teams with specific expertise

Capital Flow Optimization: Multi-jurisdictional funding structures

Security Architecture: Plausible deniability through technical design

Business Value: Delivers actual products while maintaining operational security.

The Innovation: The Intermediary Layer

Why This Layer Exists:

Traditional organizations face a fundamental tension: Innovation requires risk, but investors demand safety. The intermediary layer resolves this through:

Legal Arbitrage Networks: Offshore vehicles and prestige law firms create jurisdictional buffers

Talent Transformation Pipelines: Converting activists into developers, theorists into implementers

Plausible Deniability Systems: Separating narrative from operations while maintaining coordination

How It Works:

Revolutionary Narrative → Intermediary Layer → Practical ImplementationThe intermediary layer translates energy between domains:

Converts philosophical passion into technical specifications

Transforms regulatory constraints into design requirements

Translates cultural capital into economic value

The DarkFi Project Structure: A Case Study

Compartmentalized Teams:

Executive Layer: Interfaces with capital and regulatory environments

Narrative Team: Manages brand, philosophy, and community messaging

Technical Team: Focuses purely on protocol development

Security Team: Handles external relationships and threat mitigation

Information Architecture:

Each team operates with optimized awareness:

Narrative team knows philosophy but not technical details

Technical team knows code but not strategic objectives

Executive team knows strategy but not operational methods

This isn’t deception—it’s information security by design, preventing single points of failure.

Economic Model: Value Creation Through Translation

The Translation Economy:

The primary economic activity in this model is translating between domains:

Cultural capital → Technical specifications

Philosophical vision → Practical implementations

Regulatory constraints → Design opportunities

Revenue Streams:

Knowledge Arbitrage: Leveraging information asymmetries between domains

Talent Premium: Access to specialized networks unavailable elsewhere

Jurisdictional Optimization: Navigating regulatory environments more efficiently

Brand Valuation: Cultural narrative as appreciating asset

The Bayesian Optimization Engine

Continuous Learning System:

The architecture includes built-in feedback loops that continuously update strategy based on:

Capital Flow Patterns: Where money moves and why

Regulatory Responses: How different jurisdictions react

Community Engagement: What narratives resonate and why

Technical Performance: Which implementations work

Strategic Advantages:

Adaptive Resilience: Automatically adjusts to changing conditions

Evidence-Based Decision Making: Replaces ideological rigidity with data-driven strategy

Risk Management: Identifies threats before they materialize

Business Applications Beyond DarkFi

Potential Use Cases:

Climate Tech Startups: Balancing activist energy with corporate partnerships

Biotech Ventures: Navigating ethical concerns while pursuing breakthrough science

Space Exploration Companies: Managing public perception while operating in regulatory gray areas

AI Development: Balancing open collaboration with competitive advantage

The General Principle:

Any venture operating at the intersection of revolutionary vision and practical implementation can benefit from this architecture.

The Future of Venture Building

From Linear to Parallel Development:

Traditional: Idea → Prototype → Funding → Scale → Exit

Dual-Interface: Narrative development || Technical development → Intermediary translation → Capital integration → Network effects

Advantages Over Traditional Models:

Simultaneous Development: Narrative and technical tracks progress in parallel

Risk Isolation: Failure in one domain doesn’t collapse the entire venture

Capital Efficiency: Cultural capital reduces customer acquisition costs

Regulatory Navigation: Multiple jurisdictions provide optionality

Implementation Roadmap

Phase 1: Foundation (6 months)

Establish parallel tracks for narrative and technical development

Build intermediary legal and talent structures

Seed initial cultural capital through strategic media placement

Phase 2: Integration (12 months)

Connect narrative and technical tracks through translation pipelines

Establish Bayesian feedback systems

Begin capital flow optimization across jurisdictions

Phase 3: Scale (24+ months)

Expand intermediary layer capabilities

Develop automated translation systems

Establish venture as platform for multiple projects

The Irish Economic Parallel

Why This Emerges in Ireland:

Ireland’s economic model has always been about translation between domains:

US capital ↔ EU markets

Global tech ↔ Local talent

Corporate structures ↔ Startup innovation

This architecture formalizes what Ireland has done intuitively for decades.

The Irish Advantage:

Cultural Translation Expertise: Centuries of navigating between larger powers

Jurisdictional Flexibility: EU member with Common Law heritage

Talent Networks: Global diaspora with specialized skills

Narrative Depth: Rich storytelling tradition as economic asset

Conclusion: The Networked Venture Future

This dual-interface architecture represents the next evolution of organizational design for complex, high-stakes environments. It acknowledges that in a fragmented world, successful ventures must:

Operate in multiple domains simultaneously without internal contradiction

Leverage cultural capital as economic moat

Maintain operational security through compartmentalization

Adapt continuously through evidence-based learning

The model isn’t about creating “captured” projects—it’s about creating resilient ventures that can navigate the tension between revolutionary potential and practical constraints.

For Ireland specifically, this represents the natural evolution from being a tax arbitrage hub to becoming a sovereignty arbitrage hub—translating between different forms of sovereignty (nation-state, network-state, corporate) and creating value in the translation space.

The future belongs not to the pure revolutionaries or the pure pragmatists, but to the architects who can build bridges between them. This is the business model of those bridge-builders.

Appendix: Graph Model

mermaid

flowchart TD

CC[”Control Centroid<br/>Capital-Intelligence Fusion Node<br/>[Privacy_Asymmetry=0.95, Funding_Sovereignty=0.10]”]

%% ========== FACTION ARCHITECTURE ==========

FA[”FACTION A: Narrative/Legitimacy<br/>Controlled Dissent Management”]

FA1[”Media Pipeline Control<br/>Outlets, Writers, Narrative Framing”]

FA2[”Conference Circuit<br/>Gatekeeping & Speaking Slots”]

FA3[”Controlled Dissent Frameworks<br/>Revolutionary Rhetoric Management”]

FA4[”Ethnic/Regional Narrative<br/>Mythology & Identity Management”]

FA --> FA1

FA --> FA2

FA --> FA3

FA --> FA4

FB[”FACTION B: Operational/Capacity<br/>Technical Infrastructure Provision”]

FB1[”Ex-Intelligence Contractor Networks<br/>Ops Skills, Tradecraft, Vetting”]

FB2[”Cybersecurity Contractor Markets<br/>Private Sector Crossover”]

FB3[”Darknet/Cypherpunk Networks<br/>Technical Expertise & Credibility”]

FB4[”VC/Talent Scout Networks<br/>Funding & Recruitment Channels”]

FB --> FB1

FB --> FB2

FB --> FB3

FB --> FB4

%% ========== INTERMEDIARY LAYERS ==========

INT[”Intermediary & Cutout Layers<br/>Plausible Deniability Creation”]

C1[”Offshore Capital Vehicles<br/>Jurisdictional Obfuscation”]

C2[”Prestige Law Firms<br/>Legal Protection & Privilege”]

C3[”Security Consultancies<br/>Contractor Vetting & Placement”]

C4[”Academic/Policy Foundations<br/>Legitimacy & Grant Channels”]

INT --> C1

INT --> C2

INT --> C3

INT --> C4

REC[”Recruitment & Socialization Pipelines<br/>Talent Transformation”]

R1[”Media → Technical Pipeline<br/>Writer → Developer Transition”]

R2[”Conference → Leadership Pipeline<br/>Speaking → Project Role”]

R3[”Contractor → Core Team Pipeline<br/>External → Internal Transition”]

R4[”VC Scout → Executive Pipeline<br/>Funding → Governance Role”]

REC --> R1

REC --> R2

REC --> R3

REC --> R4

%% ========== DARKFI INTERNAL STRUCTURE ==========

DF[”DarkFi Project Layers<br/>Compartmentalized Awareness”]

EXEC[”Executive/Board Layer<br/>Capital Interface & Strategy”]

NARR[”Narrative & Ideology Team<br/>Public Philosophy & Messaging”]

TECH[”Technical Implementation Team<br/>Protocol & Application Development”]

OPSEC[”Security & Interface Team<br/>External Relationship Management”]

DF --> EXEC

DF --> NARR

DF --> TECH

DF --> OPSEC

%% ========== EXTERNAL INTERFACES ==========

COM[”Community & User Layer<br/>’Utopian Anonymity’ Engagement”]

EDA[”External Systems Analyst<br/>Infrastructure-First Critique”]

%% ========== BAYESIAN INFERENCE SYSTEM ==========

BAY[”Bayesian Evidence Processing”]

E1[”E1: Funding Pattern Analysis<br/>Multi-Jurisdiction Flows”]

E2[”E2: Regulatory Treatment Analysis<br/>’Approved Opposition’ Pattern”]

E3[”E3: Social Response Analysis<br/>Aggression Proportionality”]

E4[”E4: Technical Architecture Analysis<br/>IC Playbook Matching”]

E5[”E5: Narrative Alignment Analysis<br/>Controlled Dissent Templates”]

INF[”Bayesian Inference Engine<br/>Updates: P(Capture) 0.10 → 0.89”]

CONC[”Conclusion: High-Confidence Dual-Interface Architecture<br/>with Compartmentalization”]

BAY --> E1

BAY --> E2

BAY --> E3

BAY --> E4

BAY --> E5

BAY --> INF

BAY --> CONC

%% ========== PRIMARY INTERFACE CONNECTIONS ==========

CC -- “Capital Allocation & Regulatory Protection” --> FB

CC -- “Narrative Control & Legitimacy Provision” --> FA

FA -- “Talent Identification & Credibility Transfer” --> INT

FB -- “Operational Capacity & Security Requirements” --> INT

INT -- “Grant Funding, Legal Protection, Contractor Placement” --> REC

REC -- “Media Recruits → Narrative Team” --> NARR

REC -- “Technical Recruits → Tech Team” --> TECH

REC -- “Security Recruits → OpSec Team” --> OPSEC

REC -- “Leadership Recruits → Executive” --> EXEC

%% ========== INTERNAL INFORMATION FLOW ==========

EXEC -- “Strategic Direction & Capital Allocation” --> NARR

EXEC -- “Technical Roadmap & Resource Allocation” --> TECH

EXEC -- “Security Requirements & Interface Management” --> OPSEC

NARR -- “Philosophical Justification & Community Messaging” --> COM

TECH -- “Technical Implementation & User Applications” --> COM

OPSEC -- “Security Protocols & Trust Mechanisms” --> COM

%% ========== COMPARTMENTALIZATION BARRIERS ==========

NARR -.->|”Limited Technical Awareness<br/>No Infrastructure Access”| TECH

TECH -.->|”Limited Strategic Awareness<br/>No Capital Strategy Access”| EXEC

EXEC -.->|”Limited Operational Awareness<br/>No Contractor Network Details”| OPSEC

OPSEC -.->|”Limited Community Awareness<br/>No Narrative Control”| COM

%% ========== EXTERNAL ANALYSIS PATH ==========

EDA -- “Infrastructure-First Critique & Systems Analysis” --> DF

DF -- “Unified Defensive Response:<br/>- Narrative Dismissal<br/>- Technical Deflection<br/>- Social Aggression” --> CC

%% ========== EVIDENCE COLLECTION ==========

EXEC -.->|”Capital Flow Patterns & Regulatory Treatment”| E1

NARR -.->|”Media Alignment & Conference Funding”| E2

COM -.->|”Community Response Patterns & Social Dynamics”| E3

TECH -.->|”Protocol Decisions & Architecture Choices”| E4

FA -.->|”Narrative Frameworks & Recruitment Patterns”| E5

E1 --> INF

E2 --> INF

E3 --> INF

E4 --> INF

E5 --> INF

INF --> CONCUntil next time, TTFN.