Bitcoin: A Central Bank Digital Currency Trojan Horse?

The promise of Bitcoin and block chain technology more broadly to deliver financial freedom is eroding, while powerful special interests focus on utility, not price

The Bitcoin Preamble

TL;DR: Bitcoin has split, or ‘forked’ into a suite of versions, specifically three main versions:

Bitcoin (BTC)

the version spoken about on TV, worth $20 000 per ‘coin’ at the time of writing

Bitcoin Cash (BCH)

a relatively minor technical improvement upon Bitcoin BTC, worth $120 per coin at the time of writing

Bitcoin Satoshi Vision (BSV)

the version of Bitcoin created to be most like the Bitcoin described in the Satoshi Nakamoto White Paper, worth $50 per coin at the time of writing

TL;DR: The highest institutionally recognized use case for Bitcoin and block chain technology is using it as a data check valve for managing and pricing risks.

This is corroborated by:

TL;DR: the invention of Bitcoin allows us to anchor information and experience in cyberspace with an immutable ‘Timestamp Server’, a check valve for data, that operates without a central authority.

What makes the Bitcoin database unique:

There is no delete nor update, only create and read on the Bitcoin database

Data can only be changed forward in time, there can be no Orwellian Ministry of Truth on the Bitcoin database

Every entry on the Bitcoin database is itself unique, it is impossible to copy-paste entries on the Bitcoin database

TL;DR: The Bitcoin White Paper expects Proof of Work to secure the Bitcoin network according to sections 4, 5 and 11 of the Satoshi Nakamoto White Paper. Asymmetries of knowledge within financial Power Capital, according to my Romeo-Juliet framework (Paper: Part 1, Part 2, Part 3, Lectures: Youtube and archive.org); according to Dan Robles’ Innovation Bank framework; Nitzan and Bichler’s Capital as Power framework and Diego Gambetta’s ‘Codes of the Underworld’ framework pertaining to lemon markets and adverse selection and moral hazard in insurance markets, have all meant that Bitcoin as an industrial process has not manifested as expected in the concept.

The Information Problem

First off, it’s no use talking about whether capitalism or socialism are better until there is contractual transparency within the management or business network of industry. This is the real issue that Ye (Kanye West) is bringing to light in the music and fashion industries at this time. This is a current blind spot for Dr Craig Wright, who claims to be Satoshi Nakamoto, and is the ideological leader of Bitcoin SV. If the Bitcoin White Paper has proven anything thus far, it’s that secrets, or what Peter Thiel terms ‘uncommon knowledge’ and monopolies, whether it’s BTC’s monopoly over ASIC hashing, or nChain’s monopoly over intellectual property and the Bitcoin Association’s monopoly over the ‘Satoshi Vision’ node software, form the cornerstone of sustainable profit.

If we strip all the noise out of the Ye (Kanye West), then Dave Chappelle gives the best explanation of the dynamic: contractual obligations are not transparent within the industry of art and entertainment, and this correlates precisely with Whitney Webb’s research on the art and entertainment industry, pertaining to organised criminal links between the financial, intelligence and art and entertainment industries. Webb’s work is the continuation of Danny Casolaro’s work which has been covered in the following Technology Truth articles:

TL;DR: Whitney Webb’s story regarding Jeffrey Epstein and Ghislaine Maxwell has been brewing for a very long time under the noses of the pundits and social media ‘leadership experts’.

TL;DR: The implications of Whitney Webb’s work extent into every corner of the global economy, right now.

TL;DR: Because of the prevailing Kompromat, blackmail, and corruption networks not one of the ‘National Security’ paid shill experts are prepared to talk about what National Security is and what is means, not least former NSA contractor, Dr Craig Wright and his NSA and CIA friends.

TL; DR: The corruption runs so deep, and there is so much of it still to understand that your humble author managed to stumble upon brand new evidence pertaining to European presidential assassination and illegal arms dealing pertaining to terrorism, three decades after the events, just from what Danny Casolaro held notes on from the 1990s.

Dave Chappelle thus gives a very cogent layman’s explanation of the effects of all this on even such a talented and popular creative as himself.

“Eggs exist”

— Nick Land

The crucial, and often forgotten fact about what engineering is, is the ability for societies and communities to purchase expert and uncommon knowledge pertaining to fragile and anti-fragile things both great and small. Engineering allows us to buy time without the need for Lovecraftian artificial cybernetic brain-cell supercomputers.

The greatest and most salient material fact pertaining to how Bitcoin changes money capitalism, is that it allows engineers to create money, simply by virtue that anything less physically cannot manage current material complexity, because it’s not designed to do so. Neoliberal financial capitalism already broke in 2009, that’s what the Bitcoin Genesis Block pertains to, and what all salient empirical data points to, backed by hard economic theory and hard evidence. It doesn’t matter how hard the Bitcoin bros and mediocre tier Ayn Rand libertarian intelligence contractors like Dr Craig Wright act or think otherwise. When things fail in real life, it’s often impossible to put them back together, when they fail in silicon, refactoring code or replacing a competent is easy. This is what computer dweebs still fail to understand while they lecture everyone else about this and that in the real life they’ve never lived in, much less built or maintained anything of societal consequence in.

Rishi Sunak has recently replaced Liz Truss as Prime Minister of the UK, Sunak is and has been for some time, a strong advocate for Central Bank Digital Currencies.

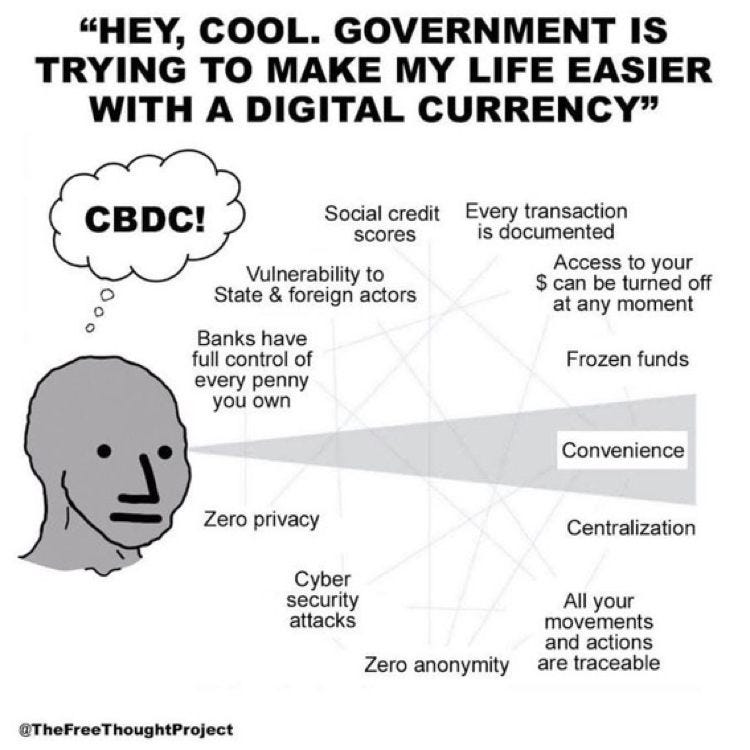

Catherine Austin Fitts explains the clear and present dangers of CBDCs in the video below, as well as with Whitney Webb on the Unlimited Hangout podcast.

The crux of the issue, for me, is that the Bitcoin Genesis block details the failure of banks, and central banks, which Dr Craig Wright largely leaves beyond criticism and reproach, to manage insurance and risk. Through the banker bailouts central banks externalized the cost of mortgage fraud not just onto the wider population, but onto future generations, without any ability for them to have any say over it. Those generations are adults now, and CBDCs, again, do nothing for them but anchor this toxic and abusive model of finance, created for the benefit of older generations and ‘elites’ (i.e. thieving greedy pigs), further without their say. CBDCs are a Venus Fly Trap policy of Orwellian control being created by special financial interests behind closed doors, with no real world engineering input, much less public disclosure and comment.

What makes Dr Craig Wright suspect to me, and why I don’t believe that he really is Satoshi Nakamoto, is his clear and open support for Central Bank Digital Currencies, via his nChain technology company: the very antithesis of the message of moral hazard prevention and decentralization of finance created and propagated in the Bitcoin Genesis block itself. The government and intelligence agencies, in collaboration with corrupt banks and central banks, stealing financial technology in order to continue being corrupt started with the INSLAW PROMIS scandal, which was heavily linked to Jeffrey Epstein and Ghislaine Maxwell, as described in previous Technology Truth articles and by Bill Hamilton, founder of INSLAW, in his sworn Affidavit.

In addition to this, Dr Craig Wright’s narrative with respect to Bitcoin being ‘stolen’ from him rests upon an elaborate conspiracy theory regarding the hidden agenda of Visa-Mastercard manifesting via a company called Blockstream to sabotage Bitcoin development. Undoubtedly Blockstream’s implementation of BTC has baked in problems with respect to scaling, but who is really attacking who with what? That’s the salient question, and also the hardest to find answers for.

However Dr Craig Wright’s nChain hired several former Visa-Mastercard employees to help advise and sell CBDC solutions to the Bank for International Settlements, the very source of all financial moral hazard according to Catherine Austin Fitts, at the CBDC Conference in Zug, Switzerland, in August 2022.

In addition to that, Bitcoin SV’s banal and asinine PR and media agency, Coingeek, shill the CBDC narrative without so much as an acknowledgement of the history of Bitcoin and why it gained adoption in the first instance, nor the serious material risks assoicated with CBDC implementation.

In fact, most people associated with Bitcoin SV view the very basis of material risk discussion pertaining to technology implementation as a personal attack as opposed to an engineering discussion. The latest example of this was the ‘Empty Block Attack’ which really wasn’t an attack at all, it related to an inherent and communicated flaw in Bitcoin SV’s infrastructure model, one that I spotted back in January. Dr Craig Wright and his cult bum chums want people to find the ‘right’ sorts of engineering problems and not the ‘wrong’ ones that ruin Craig’s tenuous and flimsy claims to being Satoshi Nakamoto, and therefore he and Calvin Ayre’s civil lawfare strategy against other market participants.

And while Dr Craig Wright and Coinkgeek are happy to draw attention to Craig’s bitching and crying on Twitter, they’re nowhere to be found when real engineering questions come up, when real questions of material risk pertaining to technology implementation come up. When questions of public safety and material risk are raised by competent authorities, the attitude of the law changes completely with respect to Dr Craig Wright’s incremental civil claims of ownership, slander, libel, et cetera, and that’s not a road he wants to go down, because the same finger pertaining to his elaborate RICO conspiracy of Visa-Mastercard, Blockstream and organised crime can be pointed back at him.

Bitcoin, and all block chains, are better thought of as immutable ledgers, than as a currency or a payment system, even though it can be used for that. Money itself can only ever be a measure of human productivity and risk management, which allows engineers to build value from the ground up, as a measure of productivity and a risk management. And the false dichotomy being set up by this rambling skeletal reptile in a skin suit called Michael Saylor, just hides the real power politics of financial capitalism driving Bitcoin, what it can really do, and its vectors of adoption, while Bitcoin BTC, pumped up via pure financial engineering, is pawned off onto the public.

The same old morally hazardous, debt-based model of neoliberal global finance is evolving, taking Bitcoin and molding it to its own ends behind the smoke and mirrors of the financial engineering associated with BTC, Dr Craig Wright’s Twitter bickering and techno-mumbo-jumbo with BSV. The real institutionally identified use case for Bitcoin, and block chain technology in general, is to hold finance to account via transparency in contracts and transparency in risk management pertaining to markets for insurance. If we don’t do that, our time is taken from us, just like Bitcoin SV’s Empty Block miner did. That’s financial capitalism too, not ‘cyber-terrorism’ according to Dr Craig Wright’s bourgeois Boomer Mondeo Man interpretation of how global financial markets work.

And while Coingeek were happy to publish Joshua Henslee’s line-toe fluff piece justifying Bitcoin confiscation by a miner who mined blocks accepted and built upon by Calvin’s Ayre’s own node operating company, and then Calvin’s Bitcoin Association’s flaccid boiled cabbage of an excuse for pursuing criminal action against the miner; at no point in the discussion did Dr Craig Wright, Calvin Ayre, nChain or the Bitcoin Association address the core problem with BitcoinSV’s mode of operation as digital infrastructure, given its inherent unsafety given pooled ASIC hashing distribution; they rather flip their lids and scream ‘cyber-terrorism’ like man-babies who shouldn’t be trusted with a box of crayons, let alone the foundation of global financial infrastructure being sold to governments as we speak.

Joshua does have interesting things to say about the core problems, but the ‘ free market capitalists’ somehow aren’t so free and easy when it comes to giving a platform to more challenging and critical opinions. My opinions are detailed here.

Meanwhile, the real digital economy created by scions of technology like Peter Thiel, Calvin Ayre, Dr Craig Wright and Michael Saylor really works like this: feeding an atomising blood sucking drug-addled flesh-farm hell-scape straight out of a William Burroughs and David Cronenberg psychological horror screenplay.

And what, precisely, about the 2008 financial crisis has been or ever will be solved by any of these people thus far?

The answer is: nothing whatsoever. Everywhere I look it’s the same people selling the same things with the same agenda behind rambling ‘cypherpunk’ fairy stories about ‘property’ and ‘decentralization’, while Visa-Mastercard and the Bank of International Settlements hardly break stride between the short con and the long one, because they see through the fake drama and the PR agency Party Line, and it’s time the rest of us wise up to that.

If you’re as fed up with this as I am, come join the re-boot of the Innovation Bank as part of the Geode Project.

TTFN and Happy Halloween.

(addendum: proof of public notice to the BitcoinSV community)